Inside Ounass: The platform powering Gulf luxury e-commerce

With just 13% of Gulf luxury sales happening online — below the 20% global average — retailers have room to grow. Ounass shows how it can be done.

With just 13% of Gulf luxury sales happening online — below the 20% global average — retailers have room to grow. Ounass shows how it can be done.

When it comes to online luxury shopping, Ounass is in a league of its own.

“The user experience is honestly excellent, the platform is smooth, the product variety is great, and the delivery speed across the Gulf is just unmatched,” said Wejdan Almalki, a Saudi luxury shopper and founder of news site Mansoooj.

Launched by Al Tayer Group in 2016, Ounass has emerged as the premier online platform for high-end fashion, beauty, and homeware. The platform lauds itself as “the definitive home of luxury, offering over 1,300 global and regional brands, including Dolce & Gabbana, Saint Laurent, and Bottega Veneta.

In fact, Ounass is responsible for 80% of all luxury e-commerce orders among the Gulf Cooperation Council (GCC) nations. Thanks to a hyper-fast delivery system offering two-hour service in Dubai and three-hour service in Riyadh, the site now boasts 4 million monthly active users and an average order value of $550, excluding beauty products.

But to fully appreciate Ounass’ lead, it’s important to understand the region’s e-commerce landscape. In the GCC, only 13% of luxury sales happen online, below the global average of 20% and far behind the UK’s average of 39%, according to Chalhoub Group.

“The primary reasons for this lower penetration include customer hesitancy toward online shopping due to concerns about size and fit, a challenging return process, distrust in online payments, and a preference for in-store fashion discovery,” states the Saudi Fashion Commission’s State of Fashion 2024 report.

While this market presents clear challenges, it also offers significant opportunities for early entrants. Chalhoub notes that the GCC’s online luxury channel is outpacing global trends, growing by 13% in 2024 compared to a global decline of between 1% and 4%. Ounass CEO Khalid Al Tayer even said in an interview that he expects half of all luxury sales in the region to move online in the coming years.

To capture this growth, global platforms like Mytheresa and Net-A-Porter have raced to expand their Middle Eastern footprint, from launching English-Arabic websites to unveiling exclusive capsule collections. Still, Ounass has the home advantage.

“Ounass is more than a retailer; it’s a case study in cultural fluency,” said Taqua Malik, founder of Freedomvisory, a Dubai-based consulting firm specialising in e-commerce.

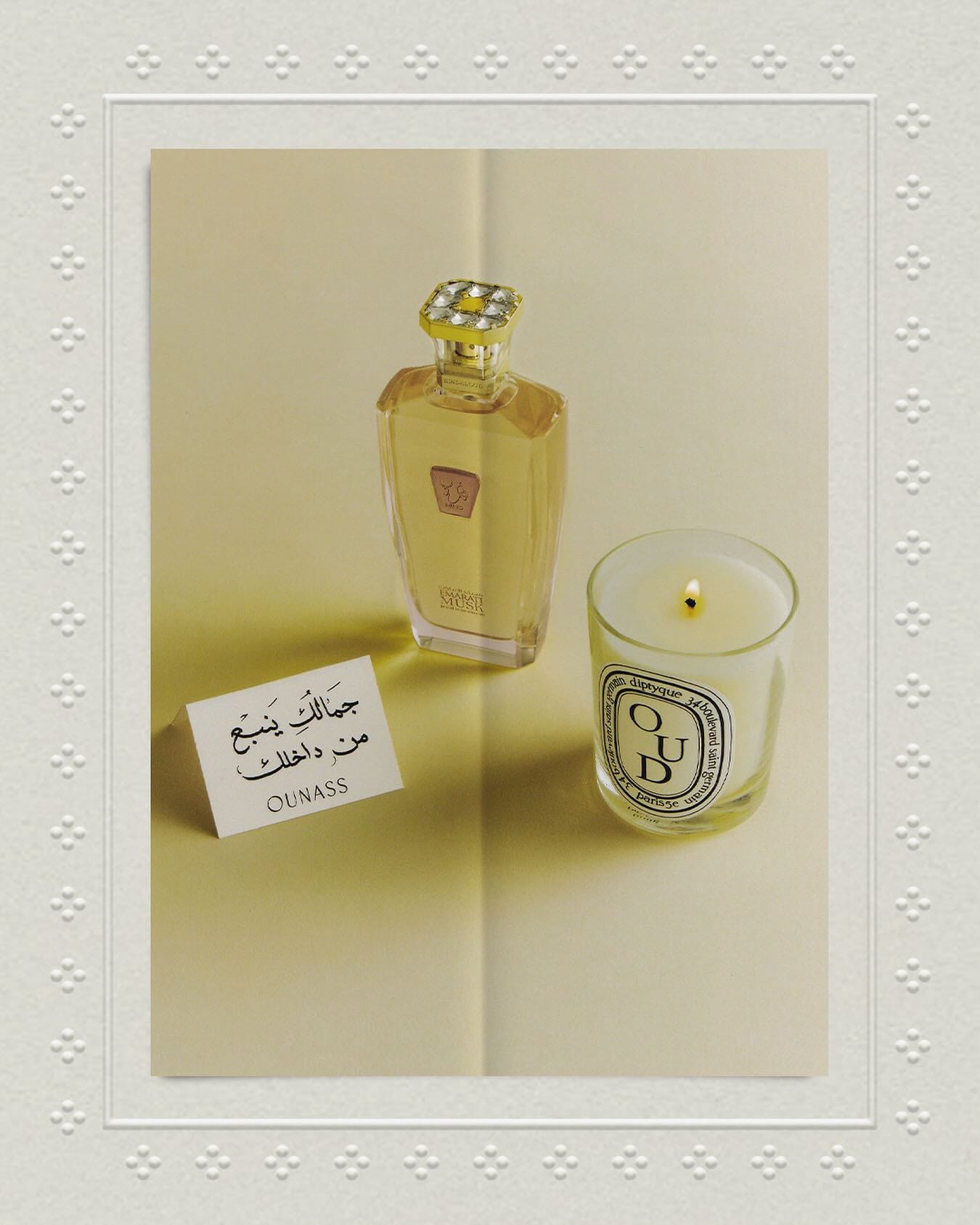

“Their formula is rooted in three principles. Service as an art form: same-day delivery, impeccable packaging, and personalised touches that make every order feel like a private appointment. Cultural connection: campaigns that honour Ramadan, Eid, and modest fashion with as much elegance as Parisian couture weeks. Trust earned daily: consistency in quality, reliability in service, and a curated selection that feels both global and distinctly regional.”

Ounass offers two-hour delivery in Dubai and express shipping to Saudi Arabia. Image: Ounass

For global brands, Ounass offers more than just speedy logistics and localised marketing – it offers access to a community of high spenders.

In April, Victoria Beckham partnered with the e-tailer to launch an exclusive capsule collection; in May, New Balance teamed up with Ounass to take over Dubai’s multi-concept space Koncrete; and in June, UK activewear brand Adanola co-hosted a pilates session with Ounass in Kuwait.

New Balance partnered with Ounass in May 2025 for an exclusive launch and Dubai pop-up. Image: Ounass

But for e-commerce competitors, Ounass presents an obvious hurdle. Malik’s advice?

“The market rewards those who embed themselves into its cultural calendar, match its delivery speed, and nurture a sense of belonging far beyond transactional exchanges.”

Saudi shopper Almalki agrees, emphasising the importance of service and speed. “Customer service and delivery speed are major factors. Ounass sets a high standard, and honestly, if other platforms can’t match that, it’s a dealbreaker. But if they offer real perks, like smart loyalty programs, cashback tie-ins, or curated edits that actually reflect our culture, I’d absolutely be open to trying them.”

While Ounass is unlikely to be unseated from its throne anytime soon, the Gulf remains ripe with opportunity. Winning brands and retailers will be those who can take a page from Ounass’ playbook and seamlessly translate the luxury experience online.