Bucking the global luxury downturn in 2024, the Gulf region is not simply resilient — it is, as Chalhoub Group puts it, “unstoppable”.

But with this opportunity comes a challenge. The market is evolving at a breakneck speed: AI is reshaping industries, rising health awareness is fuelling new categories, and expectations for cultural relevance and customisation have never been higher.

In short, the Middle East is shaping luxury on its own terms.

1. AI-powered personalisation

In the UAE, 70% of consumers now use AI-powered tools when shopping, a 44% increase from 2024, according to global fintech platform Adyen. McKinsey reports that over half of GCC organisations are investing at least 5% of their digital budget in generative AI, with their early efforts focusing on sales and marketing.

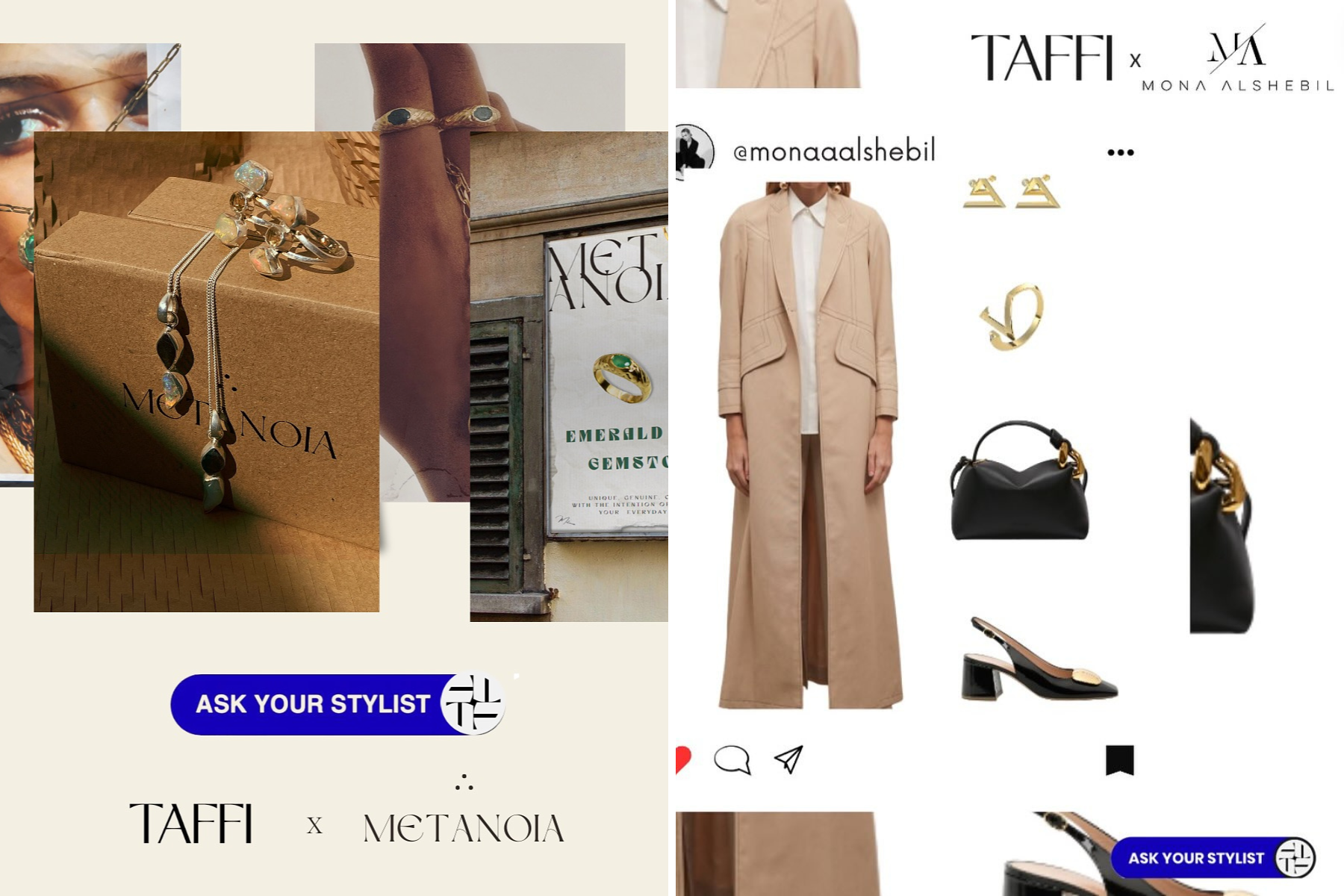

Driving this shift are players like Riyadh-based fashion marketplace Taffi, which uses an AI personal stylist to provide product recommendations, and Address Hotels and Resorts in Dubai, which employs a virtual concierge. As adoption grows, so too do expectations for personalisation and speed, raising the stakes for every luxury player.

Expert Take: “From predictive analytics that anticipate purchasing behaviour to virtual stylists that curate bespoke collections, technology is now a key driver of personalised exclusivity,” said Taqua Malik, founder of boutique cultural intelligence firm Freedomvisory.

2. Relationships beyond transactions

The rise of AI hasn’t replaced the need for clienteling; rather, it’s elevating expectations for human-led experiences. In the GCC, customer journeys still lag behind global standards, particularly in terms of advisors’ ability to forge personal connections, according to a report by Dubai-based consultancy CXG.

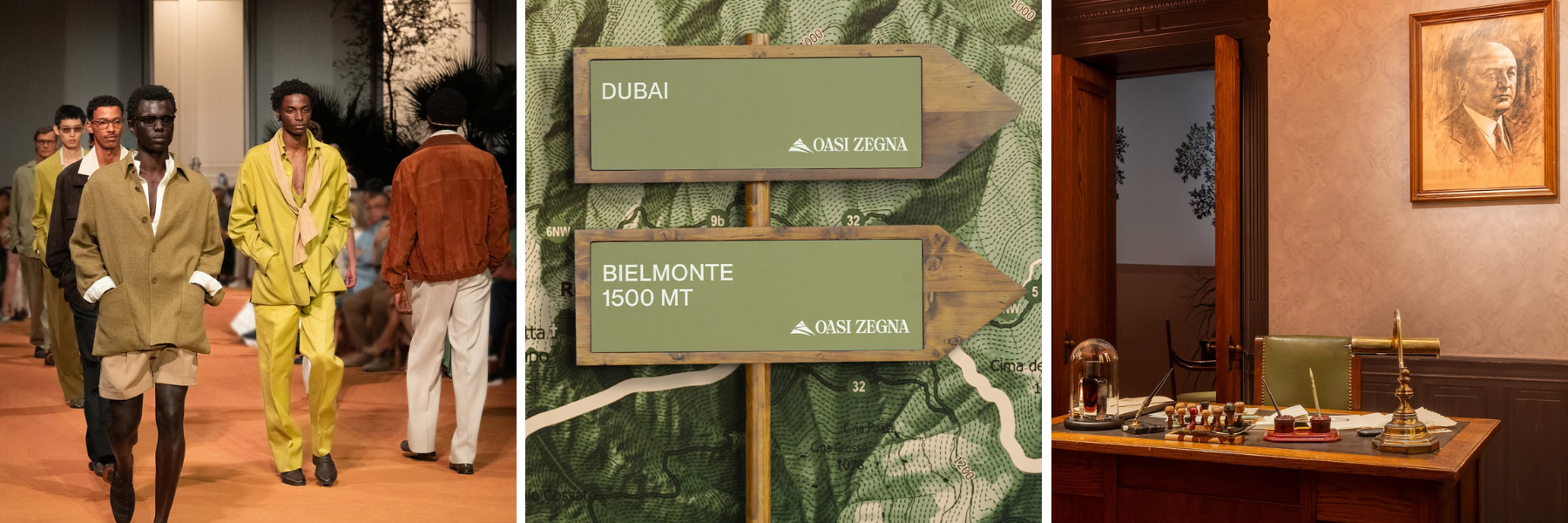

Well-travelled and globally savvy, Gulf clients expect international standards at home. They seek skilled advisors who can anticipate their needs and have access to private clubs and VIP events that foster a sense of belonging, such as the Villa Zegna pop-up in Dubai in June.

Expert Take: “One of the most defining trends reshaping luxury in the Middle East in 2025 is the rise of the self-made ultra-wealthy client. This new generation is younger, global, and highly sophisticated. They are not impressed by brand names alone. They expect meaning, storytelling, and hyper-personalised experiences that reflect who they are,” said Daniel Langer, CEO of Équité, a global luxury strategy and creative brand activation firm.

3. Global luxury with a local soul

Beyond carrying full assortments, Gulf consumers expect collections tailored to them. The Future Laboratory reports that 95% of young Saudis value brands supporting local craft, while 77% expect localised or seasonal offerings. Likewise, a BoF Insights survey shows Dubai’s 18–24-year-olds express the strongest demand for traditional and modest styles, from abayas to non-form-fitting dresses.

Brunello Cucinelli’s Spring/Summer 2025 collection catered to these preferences with modest silhouettes and a special abaya line, while Bulgari collaborated with three Gulf artists for Ramadan 2025, merging its signature aesthetic with local artistry.

Expert Take: “This generation is drawn to brands that tell a compelling story and connect with both their cultural identity and the global trends they follow. That balance between local and global is key, and brands need to be creative in fusing cultural relevance with an international edge,” said Alex Hawkins, director of strategic foresight at The Future Laboratory.

4. Premiumisation of fitness

Government initiatives promoting healthier lifestyles across the Gulf are showing results: over half of Abu Dhabi residents and Saudi adults now meet the World Health Organisation’s recommendation of at least 150 minutes of physical activity per week.

In 2025, fitness and wellness have become aspirational lifestyle markers — gateways to the best equipment, experts, and communities. SIRO One Za'abeel's premium fitness suites and Ounass's private Pilates session with British activewear label Adanola exemplify this trend.

Expert Take: “More people are embracing social, empowering sports [like pickleball and running]. And more people want to train like near-elite athletes, while pro athletes want hospitality destinations that deliver wellness, recovery treatments, and state-of-the-art gym equipment,” said Beth McGroarty, VP of research at the Global Wellness Institute.

Written by