Luxury has always sold trust. Now it has to prove it.

Across the industry, a quiet race is underway to anchor every handbag, watch and jacket to a digital record that says: this is real, and here’s how you know.

The global resale market for fashion and luxury is set to exceed USD 360 billion by 2030, expanding nearly five times faster than first-hand sales, according to a new study by Boston Consulting Group and luxury resale platform Vestiaire Collective.

Yet the same study highlights a choke point: authentication remains the weakest link in resale growth. That gap is where Digital Product Passports (DPPs) will transition from an acronym to an advantage.

From compliance to competition.

The default mindset is still compliance. Bain finds that most brands view DPPs as a regulatory task rather than a value engine. The EU’s forthcoming Ecodesign for Sustainable Products Regulation will require detailed product data by 2027, starting with the textile sector.

But the smartest brands already see a different game.

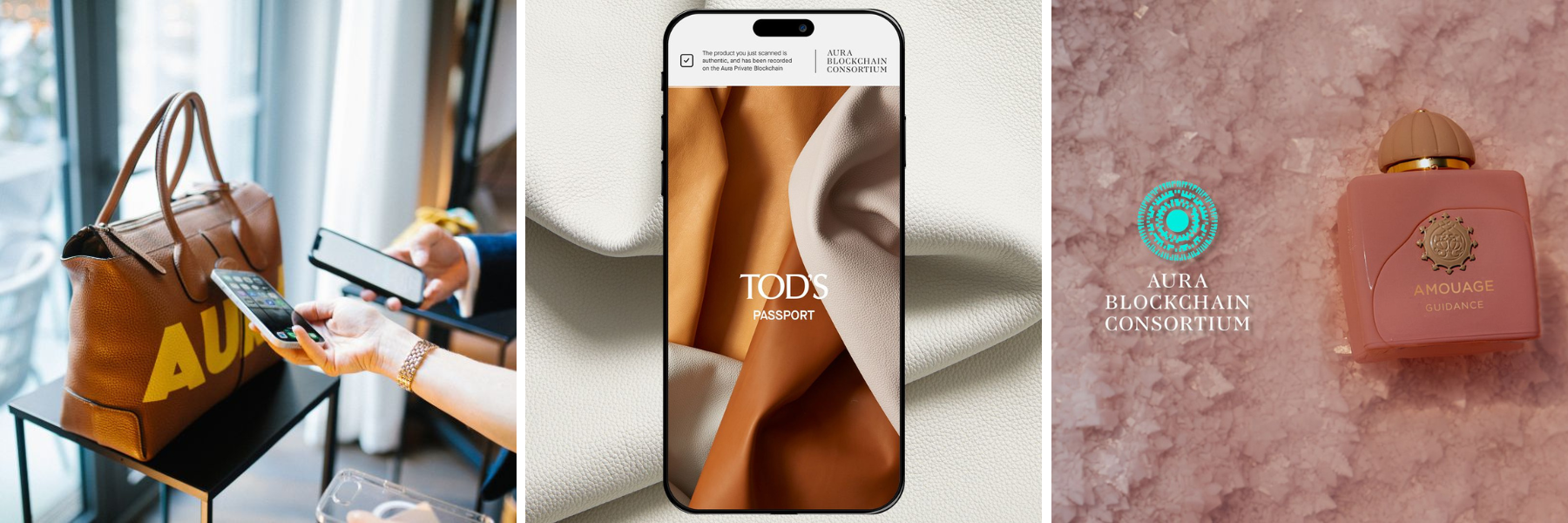

LVMH, Prada Group and Cartier’s Aura Blockchain Consortium has logged tens of millions of items with unique digital identities — not to tick a regulatory box, but to future-proof repair, resale, and loyalty.

Coach’s Coachtopia initiative ties NFC to product IDs, enabling instant resale listings via Poshmark.

Dubai is piloting regulated tokenisation and traceability for gold and diamonds through a new DMCC–VARA partnership, part of the city’s push to formalise provenance at scale.

Compliance satisfied yesterday's regulators. Tomorrow's competitive moat is proof.

The invisible brand layer.

A DPP is a digital capsule: materials, origin, repair history, and ownership—all traceable and transferable. The underlying plumbing, like GS1 Digital Link, turns an ordinary barcode into a web-addressable identity. Once that exists, every stakeholder — brand, marketplace, or consumer — can plug into it.

Who controls that identity determines who captures the value.

If the brand owns it, they orchestrate repairs and resale.

If a marketplace owns it, they control discovery and margin.

If the customer owns it, transparency wins. But loyalty must be earned.

“For consumers, trust is emotional long before it’s technical. They don’t need to see the tech,” says Simon P. Lock, co-founder and CEO of Authentique. “They need to feel certainty — that the bag they list or repair tomorrow is the same one they bought years ago.”

Proof as infrastructure

Start-ups across Europe and the Gulf are quietly building the rails.

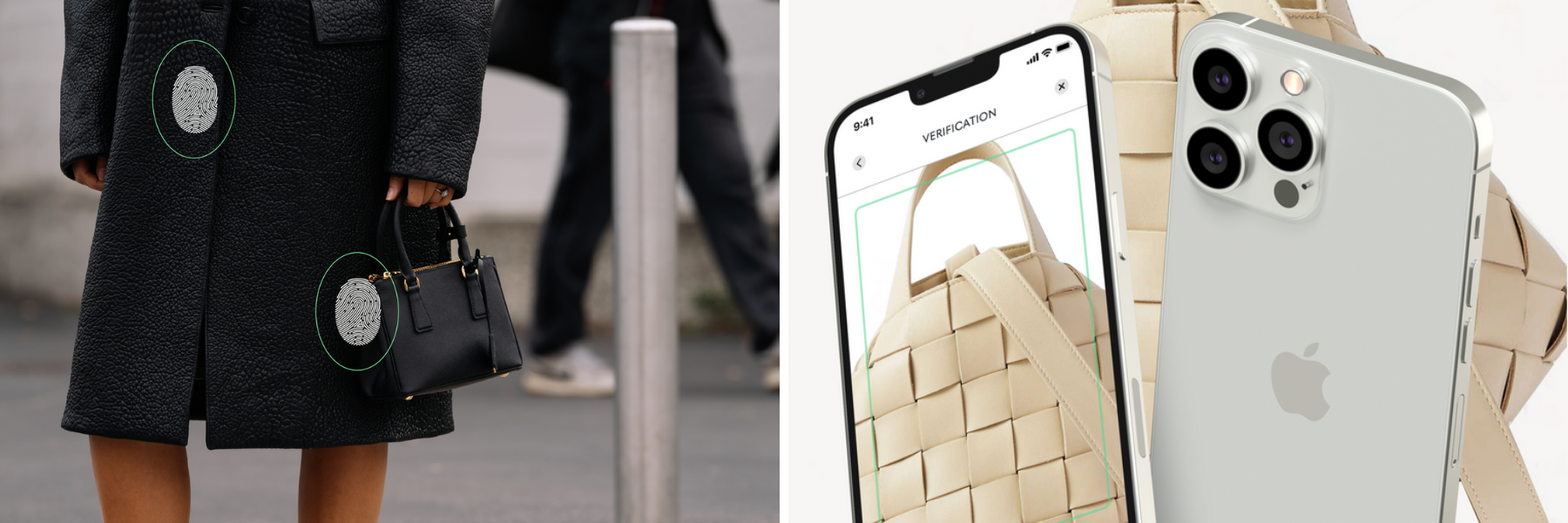

Authentique, part of the Paris-based ORDRE Group, combines optical fingerprinting with non-tamperable IDs, eliminating the need for physical tags. Zurich-based Haelixa embeds natural DNA markers at the fibre level and links them to records on TextileGenesis, an Amsterdam-founded traceability platform acquired by Lectra. Abu Dhabi–based Numeraire Future Trends integrates AI‑driven surface‑level object identification with blockchain anchoring, creating a verifiable link between a physical object and its enduring digital record.

Each solves the same challenge through distinct technologies: proof that survives ownership transfer.

What happens next?

The window for quiet experimentation is closing.

In Gulf markets, the case is even clearer. Goods often cross multiple free zones before reaching consumers, and authenticity can blur across borders. A persistent digital passport cuts through that opacity. The same record that authenticates a watch in Paris could validate its resale in Dubai — a leap for transparency in one of the world’s most dynamic luxury corridors.

By 2027, digital provenance will be as expected as care labels. The next year is therefore a race for readiness and for ownership of the data layer beneath the product.

“The passport should follow the object — ownership changes, repairs, even wear. If we hide that history, we aren’t innovating. We’re just rebuilding the same silos you claim to disrupt with sleeker interfaces," notes Dr Marsha Lipton, CEO of Numeraire Future Trends.

Luxury’s future won’t be defined by what’s on display, but by what’s provable. The mandate is inevitable. The opportunity is optional. And those who treat proof as a product in itself will write the passports everyone else has to use.

Written by