Key Takeaways:

- Over 90% of young Saudis actively use Snapchat, opening it up to 50 times a day, making it one of the Gulf’s most deeply embedded social platforms.

- High engagement, trust in peer networks, and appetite for AR/AI make Snap a powerful driver of discovery and purchase.

- Brands can maximise their impact on Snapchat by embracing native formats, collaborating with local creators, and using AR to create interactive, culturally resonant experiences.

Want to reach millions of Gen Z in the Gulf? They might just be one Snap away.

According to Snap Inc., over 90% of those in Saudi Arabia aged 13 to 34 actively use Snapchat, with some opening it 50 times a day on average. Meanwhile, users across the Gulf visit the photo-sharing platform over 45 times a day — which is still high, compared to the US average of 40.

Though not the most popular social media app by number of users, Snapchat boasts a highly engaged community, including a significant base of young, mobile-first luxury consumers who value authenticity and exclusivity.

As the app evolves, it’s not only helping global brands boost their visibility in a crowded digital marketspace but raising the bar in how they engage with the next generation of shoppers.

The business case for Snapchat

While Snapchat’s primary use case is staying connected with friends and family through disappearing photos and messages, it’s increasingly becoming a hub for brand discovery and sales.

“Snapchat is proving particularly popular,” said Alex Hawkins, director of strategic foresight at the Future Laboratory, a trend forecasting consultancy. “These are Gen Z with spending power, and they’re highly engaged on social media. That’s where they’re chatting to their friends. That’s where they’re browsing, and that’s where they’re shopping.”

In Saudi Arabia and the UAE, 97% of Snapchatters discover new products via social ads that link to product pages, while 93% actively share the brands they like, states Snap Inc. With Gulf users trusting their personal networks above all — Saudi shoppers are 8 times more likely to listen to their friends and family over influencers — the app holds significant sway over purchasing decisions.

“Digital engagement is very high, especially for Gen Z who view Snap as a primary platform to inform their choices in the luxury space. Among 18–34-year-olds, 46% [in Saudi Arabia] use predominantly digital methods for purchasing luxury goods,” Hawkins explained, citing research from The Future Laboratory’s New Codes of Luxury in Saudi Arabia report.

The luxury strategy: Leveraging AR and AI

To maximise reach while ensuring cost efficiency, Snapchat suggests splitting ad spend: up to 60% on Snap ads (single image or video ads), 40% on Story ads (collection of Snaps), and 10-20% on AR filters and lenses. But it’s really the latter two that capture active attention and increase purchase likelihood in the Middle East.

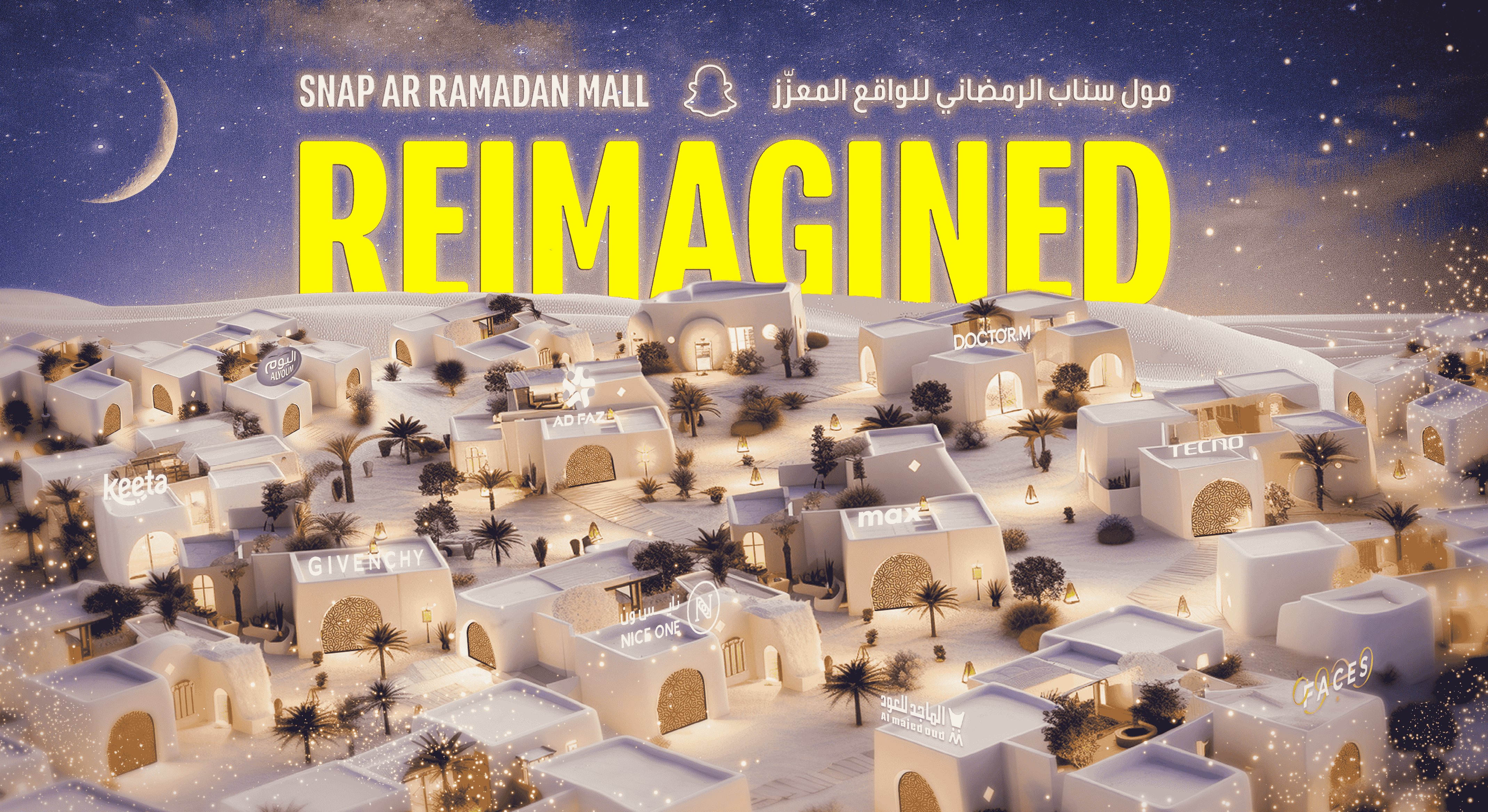

Take Snap’s annual AR Ramadan Mall, which enables shoppers to explore retailers through an immersive 360-degree function. Even during one of the busiest online shopping periods of the year, the 2024 edition managed to cut through the noise — reaching 16 million people, generating 257 million impressions, and delivering a 1.3 times average return on ad spend. Luxury brands that benefited included Givenchy, Carolina Herrera, and Arabian Oud.

According to Hala Zgeib, Head of Luxury for Snap Inc. MENA, 85% of Snapchatters in KSA and the UAE engage with AR daily, pointing to an appetite for digital experiences that are “not just entertaining but also personalised and premium.” The app’s Sponsored AI Lenses, a generative AI ad format that puts users at the centre of unique brand moments, further capitalises on this demand.

“AI and AR are redefining what consumers expect from luxury,” Zgeib explained. “They want immediacy, personalisation, and relevance, all without losing the brand’s DNA. In the Middle East, where innovation and luxury often go hand in hand, these technologies are helping brands stay aspirational while becoming more accessible.”

Why this matters

In Saudi Arabia, where 63% of nationals are under 30, and in the UAE, where nearly half of the population is aged 15 to 35, reaching luxury consumers requires more than static billboards; it requires showing up authentically on the platforms they use daily.

“To maximise impact, luxury brands should continue to embrace platform-native formats, work with local creators to tap into community influence, and experiment with AR to bring products and heritage to life in a way that’s interactive, elegant, and personal,” Zgeib advised.

Understanding this blend of international sophistication and national nuance is key, Hawkins adds. This could look like leading with Arabic-first messaging, aligning with key occasions like Ramadan, and incorporating cultural elements into products themselves.

For example, when Chalhoub’s beauty retailer Faces released an AR filter to celebrate Saudi National Day 2024, it reached 4.9 million users and achieved a 1.54% share rate, exceeding the Kingdom’s AR benchmarks by fivefold.

“As the region’s leading beauty omni-retailer, we use creative media integrations and premium placements to strengthen our brand image and reinforce our role as the personalised beauty coach for our customers,” said Darine El Sabbagh, general manager of e-commerce at Chalhoub-owned beauty retailer Faces. “Snap and particularly lens experiences allow us to deliver personalisation and immersion at scale, which are now expected in beauty retail.”